All verification documentations must be submitted to the OSFA via one of the following methods listed below:

1. Upload all completed forms via MyNKU Portal (see below for instructions)

2. Mail hardcopies of the completed forms to: Student Financial Assistance, Lucas Administrative Center, Rm 416, Nunn Drive, Highland Heights, KY 41099

3. Drop off the completed forms in-person to Norse One Stop, which is located on campus in the Lucas Administrative Center, 3rd Floor, Room 301.

Students may be chosen for Verification randomly, the FAFSA submitted was incomplete, the FAFSA contains estimated information, or the data that was provided on the FAFSA is inconsistent. NKU may select students who have conflicting information or make corrections after the student has been packaged for financial aid.

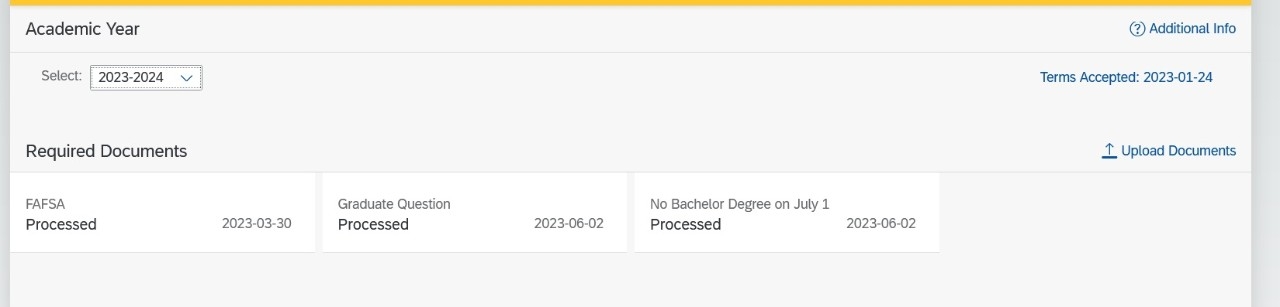

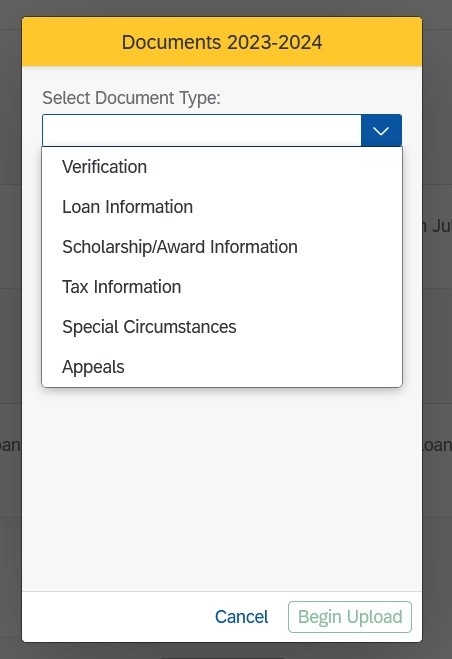

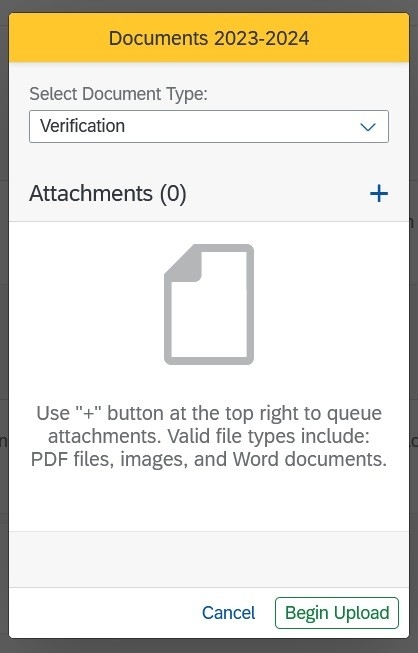

Log in to your myNKU portal, click on the financial aid tab, and then click on the documents tab. Here you will see which verification you were selected for and can download the appropriate worksheet.

If you cannot download the worksheet from myNKU, see the Office of Financial Assistance for a paper copy.

Important: The manner in which federal tax information is collected by colleges and universities has changed. Signed copies of federal tax returns (1040, 1040A, 1040EZ) are no longer acceptable documents for Verification.

Only an official Tax Return Transcript is considered acceptable documentation.

To obtain a free IRS Tax Return Transcript go to www.irs.gov and click "Order a Return or Account Transcript." Make sure to order the "IRS Tax Return Transcript" and not the "IRS tax account transcript". You may also request the tax return transcript by calling the IRS at 1-800-908-9946.

Students and their parents who are required to file a federal tax return are encouraged to use the IRS Data Retrieval Tool when completing the FAFSA. The tool allows for your federal tax information to be transferred directly to your FAFSA.

Using the IRS Data Retrieval Tool is the most accurate way to report tax information when completing the FAFSA. It is not a guarantee that you will not be selected for the Verification process if you utilize the IRS Data Retrieval Tool.

If you filed a tax return electronically, the data will be available in 1-2 weeks through the IRS Data Retrieval Tool. Allow 6-8 weeks for data from tax returns filed by paper.

How to use the Data Retrieval Tool (from http://fafsa.gov):

Please note: We suggest you provide verification documentation to our office within 30 days in order to prevent delayed disbursement of your financial aid.

Please contact the Office of Student Financial Assistance for additional information.